On this page, you will find a vocabulary list related to banking terms. There are links to games, flashcards, and other resources to help you learn and practice these terms. Explore the different tools available to enhance your understanding of banking vocabulary.

When conducting transactions at the bank, it is essential to have all necessary documents and identification on hand. Whether opening a new account, applying for a loan, or simply depositing or withdrawing funds, being prepared will help streamline the process and ensure a smooth experience. Additionally, it is important to be aware of any fees associated with the services being used and to ask questions if clarification is needed. By following these tips, customers can make the most of their time at the bank and efficiently manage their finances.

At The Bank Vocabulary List

Opening a new account

- I had to show my driver's license and social security card for identification when opening a new account at the bank.

- The teller asked for two forms of identification before processing my application for a new account.

- Make sure to bring a valid form of identification with you when you go to the bank to open an account.

- I made a large deposit of $500 into my savings account.

- The bank required a minimum deposit of $100 to open a new account.

- I always try to deposit my paycheck as soon as possible to start earning interest.

- She carefully practiced her signature until it was perfect.

- The contract required both parties to provide their signatures.

- The artist proudly displayed their signature style in each piece of work.

- I need to select the appropriate account type for my new savings account at the bank.

- The account type you choose will determine the features and benefits of your financial account.

- Make sure you understand the fees and restrictions associated with each account type before opening an account.

- I had to undergo a credit check before being approved for a mortgage.

- The landlord required a credit check before approving my rental application.

- The car dealership ran a credit check before offering me financing options.

- Please be sure to keep a minimum balance of $500 in your checking account to avoid any monthly maintenance fees.

- It is important to be aware of the minimum balance requirements for your savings account to prevent any penalties.

- Failure to maintain the minimum balance in your account may result in additional charges from the bank.

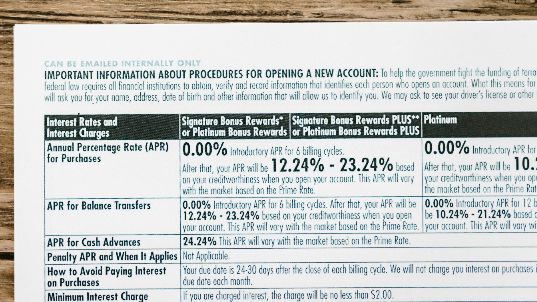

- I carefully reviewed the account agreement before signing up for a new checking account at the bank.

- The account agreement clearly outlined the fees and interest rates associated with the savings account.

- It is important to read and understand the account agreement before opening any new financial account.

- I submitted my application for the new account at the bank yesterday.

- The online application process was quick and easy to complete.

- My application for the credit card was approved within 24 hours.

Depositing money

- I made a cash deposit of $100 at the bank this morning.

- The teller confirmed my cash deposit and provided a receipt for my records.

- I prefer making cash deposits through the ATM for convenience and efficiency.

- I initiated a wire transfer to send money to my friend who lives overseas.

- The wire transfer was completed successfully, and the funds were credited to the recipient's account.

- Wire transfers are a convenient and quick way to transfer money between accounts.

- I set up an electronic funds transfer to pay my monthly bills automatically.

- The company prefers electronic funds transfers for all transactions to ensure timely payments.

- We can process your refund through an electronic funds transfer directly to your bank account.

- I made an ATM deposit of $100 into my checking account yesterday.

- Please remember to fill out a deposit slip before making an ATM deposit.

- The ATM deposit was processed immediately and the funds were available in my account within minutes.

- I love being able to conveniently make a mobile deposit whenever I receive a paper check.

- The mobile deposit feature on my bank's app has saved me so much time.

- After taking a picture of the check, the mobile deposit process is quick and easy to complete.

- I prefer to receive my paycheck through direct deposit for faster access to my funds.

- Setting up direct deposit with my employer was a simple process that saved me time and hassle.

- Many companies now offer direct deposit as the preferred method of payment for employees.

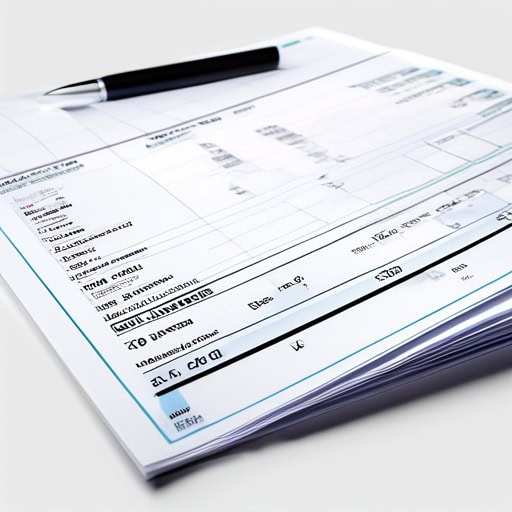

- I made a deposit of $100 into my savings account yesterday.

- The bank requires a minimum deposit of $25 to open a new checking account.

- To secure the apartment, we had to put down a deposit of one month's rent.

Withdrawing money

- I always strive to maintain a healthy balance in my bank account to avoid any financial stress.

- It is important to constantly monitor your spending and income to ensure that you have a sufficient balance in your account.

- By practicing good financial habits, such as budgeting and saving, you can easily maintain a positive balance in your bank account.

- I was surprised to see that my bank charged me a withdrawal fee every time I took money out of my account.

- The withdrawal fee was higher than I expected, so I decided to withdraw a larger amount to minimize the number of fees I would incur.

- After learning about the withdrawal fee, I started to only withdraw money when absolutely necessary to avoid unnecessary charges.

- I reached my withdrawal limit for the day after trying to take out $500 from the ATM.

- The bank has a daily withdrawal limit of $300 for all customers to prevent fraud and unauthorized access to funds.

- I had to call my bank to request an increase to my withdrawal limit in order to pay for a large purchase.

- I completed a transaction at the bank this morning to withdraw cash for my vacation.

- The online transaction for my new laptop went through smoothly without any issues.

- After the transaction was approved, the funds were immediately available in my checking account.

- I need to withdraw some cash from the ATM before heading to the store.

- She forgot to withdraw money from the bank before going on her trip.

- Please remember to withdraw enough cash for the weekend from the teller.

- My bank account is currently overdrawn because I forgot to deposit my paycheck before making a large purchase.

- I was shocked to receive an overdraft fee notification from the bank after realizing that I had overdrawn my account.

- I need to transfer some funds from my savings account to cover the overdrawn amount in my checking account.

Applying for a loan

- My credit score dropped after missing a few payments on my credit card.

- Having a high credit score can help you qualify for lower interest rates on loans.

- It's important to regularly check your credit score to ensure accuracy and monitor your financial health.

- I have a 30-year loan term for my mortgage, allowing me plenty of time to pay it off.

- The loan term for my car loan is 5 years, with monthly payments that fit my budget.

- I prefer shorter loan terms so I can pay off the debt sooner and save on interest payments.

- The bank offered a competitive interest rate on the mortgage, making it an attractive option for homebuyers.

- When investing in a bond, it's important to consider the current interest rate environment to ensure a favorable return.

- A lower interest rate on a credit card can save you money on interest payments over time.

- I had to save up for months in order to afford the down payment on my new car.

- The down payment on the house was more than we expected, but we were able to make it work.

- The dealership required a 20% down payment in order to finance the new vehicle.

- Her debt-to-income ratio was too high to qualify for the mortgage.

- The lender required a debt-to-income ratio of less than 43% for approval.

- Before making any large purchases, it's important to consider how it may affect your debt-to-income ratio.

- My credit history is clean and I have always made timely payments on my loans and credit cards.

- Unfortunately, my credit history took a hit when I missed a few payments during a financial rough patch.

- Before applying for a mortgage, it's important to review and improve your credit history to increase your chances of approval.

- My father agreed to be my cosigner on the car loan.

- The bank required a cosigner for the loan because of my limited credit history.

- I had to find a cosigner for my apartment lease since I was a first-time renter.

- The bank required the borrower to provide collateral in the form of his car in order to secure the loan.

- The lender accepted the house as collateral for the business loan.

- If the borrower defaults on the loan, the lender has the right to seize the collateral.

ATM

- I lost my debit card and had to call my bank to report it missing.

- I use my debit card to make all of my purchases instead of carrying cash.

- I always check my bank statement to make sure there are no unauthorized charges on my debit card.

- Please input your PIN number to access your account.

- Make sure to keep your PIN number confidential.

- I forgot my PIN number and had to reset it at the bank.

- I was surprised to see a $3 ATM fee on my bank statement after using an ATM at a gas station.

- Some banks waive ATM fees for certain account holders, which can save customers money.

- Before using an ATM, it's important to check if there will be any ATM fees associated with the transaction.

- I need to make a balance inquiry at the ATM before I can withdraw any money.

- She quickly made a balance inquiry on her phone to see if she had enough funds to make a purchase.

- The balance inquiry on my bank statement showed that my account was in good standing.

- I needed some fast cash to pay for the unexpected car repair.

- The pawn shop offered fast cash in exchange for my old jewelry.

- I was able to get fast cash by selling some items online.

- I checked my mini statement at the ATM to see if my recent deposit had gone through.

- The mini statement showed that I had made three purchases that I didn't remember making.

- Before leaving the bank, I always make sure to print a mini statement to keep track of my spending.

Quick Facts

- Banks were originally established in ancient civilizations to provide loans to farmers and traders.

- The first modern bank was founded in 1397 in Italy, and it was called Banca Monte dei Paschi di Siena.

- The term “bank” comes from the Italian word “banca,” which means bench. In the Middle Ages, moneylenders conducted their business on benches in the marketplace.

- The United States has the most banks in the world, with over 5,000 commercial banks.

- The first ATM (Automated Teller Machine) was installed by Barclays Bank in London in 1967.